Not sure if you will file and pay your taxes due by April 15?

Here’s what you need to know about filing an extension.

Sometimes, events beyond your control keep you from making that dreaded April 15 income tax filing deadline. Too much time at work, family emergencies, a complicated financial situation or missing forms are common reasons.

Even though tax season is at the same time each year, we’re just not ready to dedicate our scarce time to the stressful task.

For this reason, the IRS provides a six-month extension period. If you think you’re going to miss that deadline this tax year, there are seven (7) things you should know.

- You can file for an extension. If you’re a U.S. taxpayer, you’re eligible to file for what the IRS calls an “automatic” extension. The agency does not require an explanation for your request.

- The IRS still wants you to pay your anticipated tax amount due by April 15. Although you are not required to make a payment when you file your extension, there is no extension for when the taxes are actually due. Does this mean that you must submit the amount owed by April 15? No, however, consider paying the amount you anticipate owing, if at all possible, otherwise the interest and penalties can add up.

- The IRS charges interest on late payments made with your extension. You’ll pay interest on any unpaid amount until you pay your tax in full.

- The IRS will assess a late payment penalty for every month or part of a month past April 15, 2014 that total tax remains unpaid. If you do not pay your taxes by the tax

deadline, you normally will face a failure-to-pay penalty of ½ of 1 percent of your unpaid taxes. That penalty applies for each month or part of a month after the due date and starts accruing the day after the tax-filing due date. If by April 15th you requested an extension of time to file your individual income tax return and paid at least 90 percent of the taxes you owe with your request, you may not face a failure-to-pay penalty. However, you must pay any remaining balance by the extended due date. For this reason it is better to overestimate the amount of taxes you owe. If you overpay, you will receive the over-payment by way of a tax refund when your taxes are filed.

taxes. That penalty applies for each month or part of a month after the due date and starts accruing the day after the tax-filing due date. If by April 15th you requested an extension of time to file your individual income tax return and paid at least 90 percent of the taxes you owe with your request, you may not face a failure-to-pay penalty. However, you must pay any remaining balance by the extended due date. For this reason it is better to overestimate the amount of taxes you owe. If you overpay, you will receive the over-payment by way of a tax refund when your taxes are filed.

- You can ask that the late payment penalty be waived because of your circumstances. If you have extenuating circumstances and believe the penalty should be excused, attach a written explanation to your 1040 when you submit it. In order to be considered for penalty forgiveness, the IRS requires that you’ve paid at least 90 percent of your tax liability by April 15th.

- Failure to file on time. There may also be a penalty for filing late. Late filing penalties are usually charged when a return is filed after the due date (including extensions). The IRS penalty for filing late is normally 5 percent of the unpaid taxes for each month or part of a month that a tax return is late. That penalty starts accruing the day after the tax filing due date and will not exceed 25 percent of your unpaid taxes.

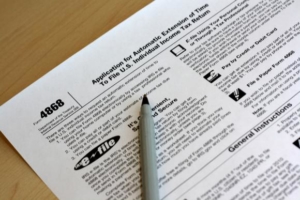

- There are three ways to file an extension using Tax Form 4868. Filing for a

personal tax extension is as simple as completing and submitting a one-page form to the IRS. The extension is automatic and you can fill the form out yourself. Submit the entire amount due, or a portion of it, and submit the form using one of these methods. For corporations and partnerships, the form is different.

-

- E-file Form 4868;

- Mail the official paper IRS Form 4868 form;

- File the Form 4868 using the Electronic Federal Tax Payment System (EFTPS)

Conclusion

Submitting a late tax return is sometimes unavoidable and more time is needed to make sure that your return is correct. IRS penalties can get expensive. Often, spending time on bookkeeping to prepare for taxes is not the best use of your time. Talk to us about your bookkeeping needs. Tax time doesn’t have to be a miserable time of the year!

Focus on what you do best

YourBizManager can help! You can start the process by sending us an e-mail to info@YourBizManager.com or by texting or calling 424-246-6006.

Receive a FREE consultation and 50% off

Click here or contact us to receive your free consultation and 50% off your first four (4) hours of service. Just mention this post.

About Doris Cristiano & YourBizManager

About Doris Cristiano & YourBizManager

As an independent bookkeeper, Doris Cristiano has been providing flexible business services on the west-side of Los Angeles since 1997. To support business needs and growth, YourBizManager tailors its services to each unique situation and works closely with its Clients’ at their business or home office. More About Us